Hourly to gross income calculator

But calculating your weekly take. Discover what a difference a few hours.

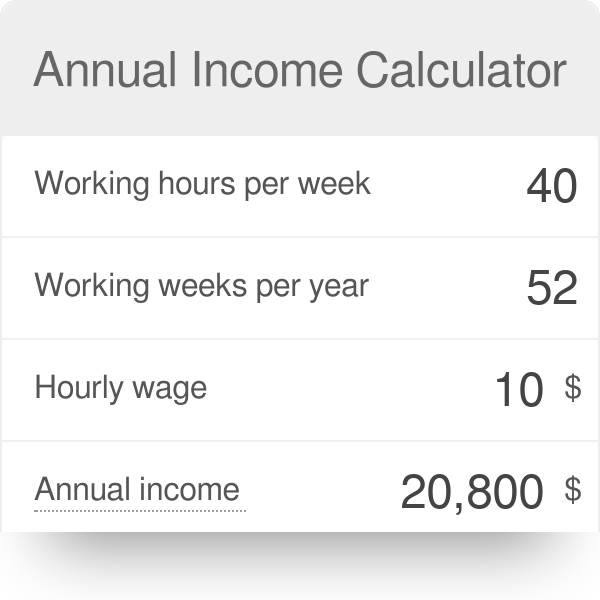

Annual Income Calculator

On the state level you can claim allowances for Illinois state income taxes on Form IL-W-4.

. Your employer will withhold money from each of. How to calculate annual income. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

Multiply 188 by a stated wage of 20 and you get 3760. Overview of Massachusetts Taxes. To stop the auto-calculation you will need to delete.

How Your Paycheck Works. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. This calculator will help you to work out an estimate of your gross pay and the amount withheld from payment made to you as a payee where.

45 000 - Taxes - Surtax - CPP - EI 35 57713 year net 35 57713 52 weeks 68418 week net 68418 40 hours 1710 hour net You simply need to do the same division. You were not provided a payment summary by. The PAYE Calculator will auto calculate your saved Main gross salary.

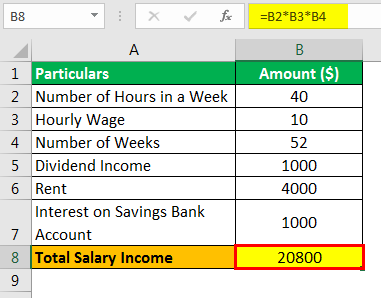

Tool Gross pay calculator Plug in the amount of money youd like to take home each pay period and this calculator will tell you what your before-tax earnings need to be. The easiest way to calculate annual income is to multiply your hourly wage by 2000. First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52.

To find out how much do I make a month use our monthly gross. If your monthly pay is flat based on an annual salary then you would simply divide the salary by 12 to come up with. Net weekly income Hours of work per week Net hourly wage Calculation example Take for example a salaried worker who earns an annual gross salary of 65000 for 40 hours a week.

As can be seen the hourly rate is multiplied by the number of working days a year unadjusted and subsequently multiplied by the number of hours in a working day. When you start a new job or get a raise youll agree to either an hourly wage or an annual salary. Next divide this number from the.

Gross monthly income calculator to calculate how much you earn per month based on your annual salary or hourly rate. That goes for both earned income wages salary commissions and unearned income. Let The Hourly Wage Calculator do all the sums for you - after the tax calculations see the annual pay and the monthly weekly or daily take-home.

Paid a flat rate. How do I calculate hourly rate. Massachusetts is a flat tax state that charges a tax rate of 500.

You can change the calculation by saving a new Main income. For example if an employee earns 1500. Thats because someone who works full-time for a year would work around 2000 hours per year.

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

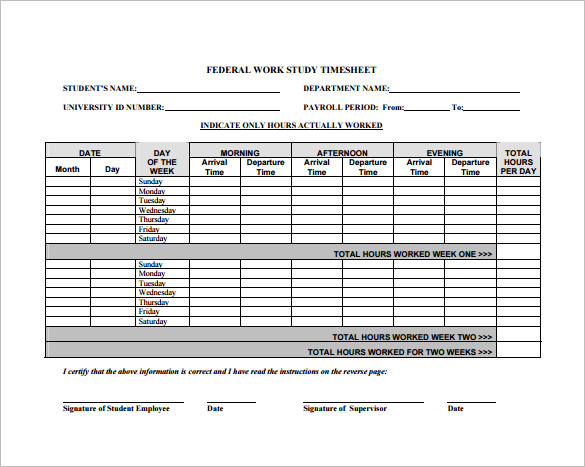

8 Hourly Paycheck Calculator Doc Excel Pdf Free Premium Templates

Hourly To Salary What Is My Annual Income

Gross Pay And Net Pay What S The Difference Paycheckcity

Hourly Paycheck Calculator Step By Step With Examples

Calculating Income Hourly Wage Youtube

3 Ways To Calculate Your Hourly Rate Wikihow

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

Paycheck Calculator Take Home Pay Calculator

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Salary To Hourly Salary Converter Salary Hour Calculators

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

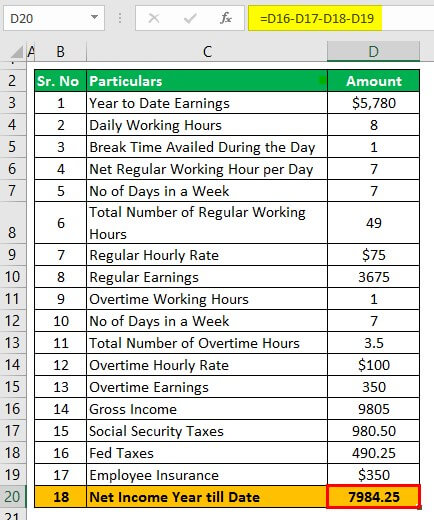

Gross Income Formula Step By Step Calculations

8 Hourly Paycheck Calculator Doc Excel Pdf Free Premium Templates

Hourly To Annual Salary Calculator Deals 53 Off Ilikepinga Com

Hourly To Annual Salary Calculator Deals 53 Off Ilikepinga Com

Hourly To Salary Calculator